Contents of this article

- 1. How to account for the second-hand car sales of transportation companies

- 2. How to record the used cars purchased by the company?

- 3. Used car company financial accounting form

- 4. How does a used car trading company prepare accounts and file taxes?

How to do accounting for transportation company’s used car sales

1. When purchasing a second-hand car:

Debit: Fixed assets

Taxes payable - value-added tax payable (input tax)

Credit: Bank deposits

When accruing depreciation:

Debit: Management expenses, etc. (included into corresponding accounts according to the department to which fixed assets belong)

Credit: Accumulated depreciation

2. When selling a second-hand car:

Transfer to fixed assets for liquidation:

Debit: Fixed assets Liquidation

Accumulated depreciation

Provision for impairment of fixed assets

Credit: fixed assets

When liquidation expenses occur:

Debit: Liquidation of fixed assets

Tax payable - value-added tax payable (Input tax)

Credit: bank deposit

When receiving income from selling second-hand cars:

Debit: bank deposit

Credit: fixed asset liquidation

Tax payable— - Value-added tax payable (output tax)

Net profit and loss from liquidation:

Realized net income:

Debit: Fixed asset liquidation

Credit: Asset disposal profit and loss

Realized net loss:

Debit: Profit and loss from asset disposal

Credit: Liquidation of fixed assets

How to record second-hand cars purchased by the company

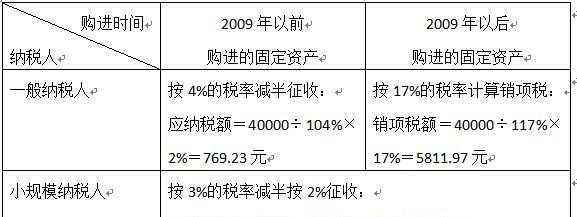

The purchase of second-hand cars is calculated as fixed assets in accounting.

Borrow: Fixed assets 110,000

Loan: bank deposit 110,000

According to the "Interim Regulations of the People's Republic of China on Vehicle Purchase Tax" (Order No. 294 of the State Council of the People's Republic of China): "Article 8 Vehicle purchase tax shall be collected once ”

When purchasing a second-hand car, you need to go through the transfer procedures in accordance with legal procedures, and you need to ask the other party for a vehicle purchase tax payment certificate.

Expansion information:

According to Article 15 of the "Interim Regulations of the People's Republic of China on Vehicle Purchase Tax" If a tax-exempt or tax-reduced vehicle no longer falls within the scope of tax exemption or tax reduction due to transfer, change of use, etc., the change must be made before going through the vehicle transfer procedures or Vehicle purchase tax must be paid before vehicle registration procedures.

Baidu Encyclopedia Interim Regulations of the People's Republic of China on Vehicle Purchase Tax

16 Share Report

Used car company financial accounting form

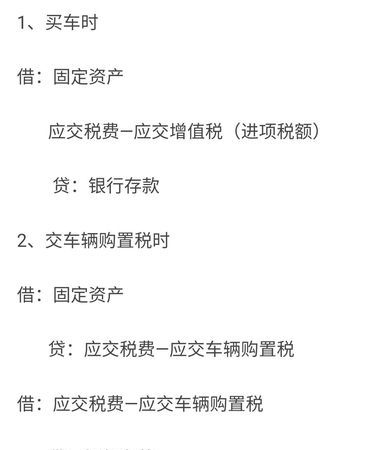

1. How to handle the accounting when purchasing a vehicle from others

Borrow: Inventory goods - used cars

Taxes payable - VAT payable (input tax)

(Special VAT invoices cannot be obtained Do not make this entry)

Credit: Cash on hand

etc.

2. What to do with the received car after selling it

Debit: Cash on hand

etc.

Credit: Main business Business income

Taxes payable—VAT payable (output tax)

At the same time

Debit: Main business costs

Debit: Inventory goods—used cars

3. For acquisitions When a vehicle is repaired and then sold, how to deal with the maintenance costs

Debit: Inventory goods—used cars

Credit: Raw materials

/

Employee compensation payable

/

Accumulated depreciation

etc.

4. How to carry forward costs and income (carry forward at the end of the period)

Debit: Profit for the year

Credit: Main business costs

Administrative expenses

Business taxes and surcharges

Borrow: Main business income

Credit: Profit for the year

VAT carryover

1) Input tax carryover:

Debit: Taxes payable - VAT payable (transferred but not paid Value-added tax)

Credit: Tax payable - Value-added tax payable (input tax)

2) Output tax carried forward:

Debit: Taxes payable—VAT payable (output tax)

Credit: Taxes payable—VAT payable (unpaid VAT transferred out)

3) Carry forward the VAT payable (That is, the difference between import and sales):

Debit: Taxes payable - VAT payable (transfer unpaid VAT)

Credit: Taxes payable - VAT payable - VAT unpaid

How does a used car trading company prepare accounts and file taxes?

Used car trading companies can use financial software on the market to keep accounts. Such as UF, Kingdee, etc. The purchase of second-hand cars is included in the company's inventory, and is transferred to the main business costs after sales.

The above is all about the financial accounting of used car companies, how to do accounting for used car sales of transportation companies, and related content of used car companies. I hope it can help you.