Body

Contents of this article

- 1. How to prepare accounts for a steel trading company

- 2. Complete accounts of steel trading companies

- 3. What kind of work do accountants in steel trading companies need to do?

- 4. I just joined a steel trading company as an accountant. How about that?

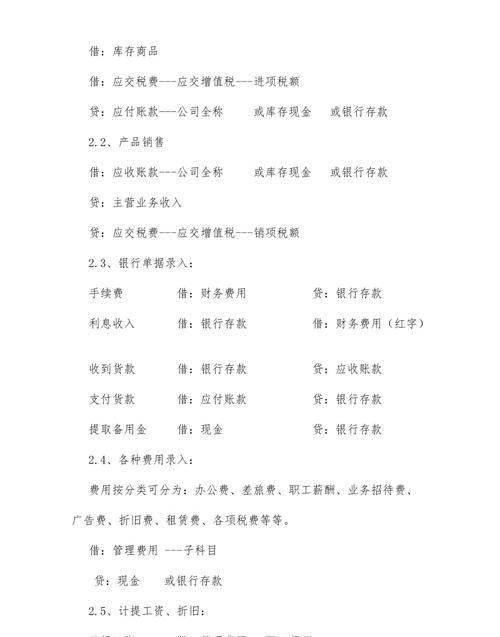

How to make accounts for a steel trading company

No matter which company it is, it is necessary to pay attention to the assets and liabilities in the accounting. To put it simply, it means how much the company invested, how much it used, and whether it made a profit or a loss. It is necessary to make 1. records of receipt and delivery of inventory goods, including quantity and amount; 2. cash bank receipts and payments records;

3. how much money the company owes to the outside world; 4. how much money the company owes to the outside world

5. Various items Reasonableness of expenditures.

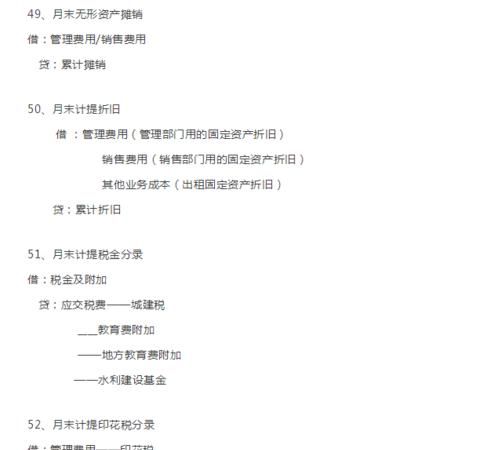

Complete accounts of steel trading companies

The following is the complete set: Download of Ruiyi EXCEL financial statements (with formulas)

including: vouchers, general ledger, ledger, object account, T-type account, balance sheet, profit and loss statement, cash flow statement, and asset management financial forms of each bank etc. With a full set of formulas, as long as the basic data is filled in, summary data and related data will be automatically generated, minimizing the workload of financial tabulation.

More than 600 sets of tables: ***/soft/304.htm

In addition, the simplified version of Ruiyi Financial Management is suitable for small and medium-sized company accountants and merchants.

Secure download: ***/soft/306.htm

Ruiyi Financial Management Professional Edition is suitable for any company and unit. It can create beautiful ledgers, details, balances, vouchers, reports, multiple sets of general ledgers, and more than 100 Complete accounts to realize automatic processing of payroll settlement, transfer, sales, loans and other businesses.

Address: ***/soft/415.htm

Follow the prompts to install and use it permanently.

What kind of work do accountants in steel trading companies need to do?

How many types of taxes are involved depends on the specific business. For example:

1. If you are engaged in the sale of steel products, you must pay value-added tax.

2. With value-added tax, urban construction tax and education surcharge must be paid.

3. If you own your own property for business, you will have to pay property tax, and if you occupy state-owned land, you will also have to pay land use tax.

4. If it is a company, it must pay corporate income tax. If it is a sole proprietorship or partnership, it does not need to pay corporate income tax.

5. If signing a contract, stamp duty will be involved, and there may also be vehicle and vessel usage tax, etc.

The most basic work that an accountant has to do is bookkeeping and accounting. From the purchase of materials to the issuance of financial statements, including the handling of taxes, there are many accounting things. Advanced ones also include financial analysis, business decision-making, etc. It cannot be explained clearly in a few sentences.

I just joined a steel trading company as an accountant. How about it?

Excel accounting processing is a free and universal accounting template. Just enter the voucher.

Journal, detailed ledger, general ledger, income statement, and balance sheet are automatically generated.

Download it from the web page on your computer (this page is known by Baidu), and enable [Macro] when opening it after downloading.

Read the instructions first. On the third line of the voucher page. .

For reference. .

Note: Electronic files need to be backed up frequently and kept on two different media, such as hard drives and USB flash drives, to prevent accidents and avoid data loss. .

The above is all about the complete accounts of steel trading companies, how to make accounts of steel trading companies, and related content of steel trading companies. I hope it can help you.